Diversify to succeed: the advantages of including private capital in your portfolio

8 MIN

8 MIN

Variety in the kitchen and the investment portfolio

1:06

2:31

3:30

4:44

6:14

After all these years involved in investments, if you ask me which is the most important factor or rule when managing a fund, it would probably be diversification; that is how important and critical it is. Diversifying helps us reduce risk by maintaining investment opportunities.

I see diversification in three dimensions, and it is very important to consider each one. The first and perhaps the most well-known is investing in assets that are decorrelated, that behave differently.

The second dimension is not to invest everything suddenly in one thing, but to gradually build your portfolio, year by year.

Lastly, it would be temporary diversification, which is considering investments over a certain period. Investments with a time horizon of "x" years have a much lower risk; for example, investing over 10 years (typical in private capital), can reduce the risk of a portfolio by three, more or less.

Therefore, when we diversify, we have to carefully consider the three dimensions: diversify by type of assets, invest gradually and invest in the long term.

It can help us a lot and very effectively, especially recently with the democratisation of private capital. Almost any investor can gain access to the diversification provided by private capital, which was previously reserved for a few.

If earlier I said that there were three dimensions, these three dimensions are perfectly reflected in private capital. On the one hand, because private capital is a very different type of investment to traditional fixed income or investments in the stock exchange or a fund, etc.

On the other hand, because private capital runs behind something called vintage years, that is, building a portfolio by investing from one year to another... Lastly, it is an investment with restricted liquidity. When you invest in private capital, it is normal to invest over 8, 10 or 12 years; therefore, this time-based diversification is inherent to private capital.

I will begin with a popular saying used by many people: "the higher the risk, the higher the returns” or “if you want higher returns, you have to take on more risk". I would say that you could add "the higher the risk, the higher the returns, if the investment is well diversified".

What is the difference between a well-diversified portfolio and a poorly diversified portfolio with an equal risk? A poorly diversified portfolio involves wasting bullets, as with the same risk you receive lower returns; the market will not pay you for that poor diversification. However, if the entire risk is highly diversified, you will obtain higher returns with the same level of risk.

You will receive higher returns, but make sure that there is diversification.

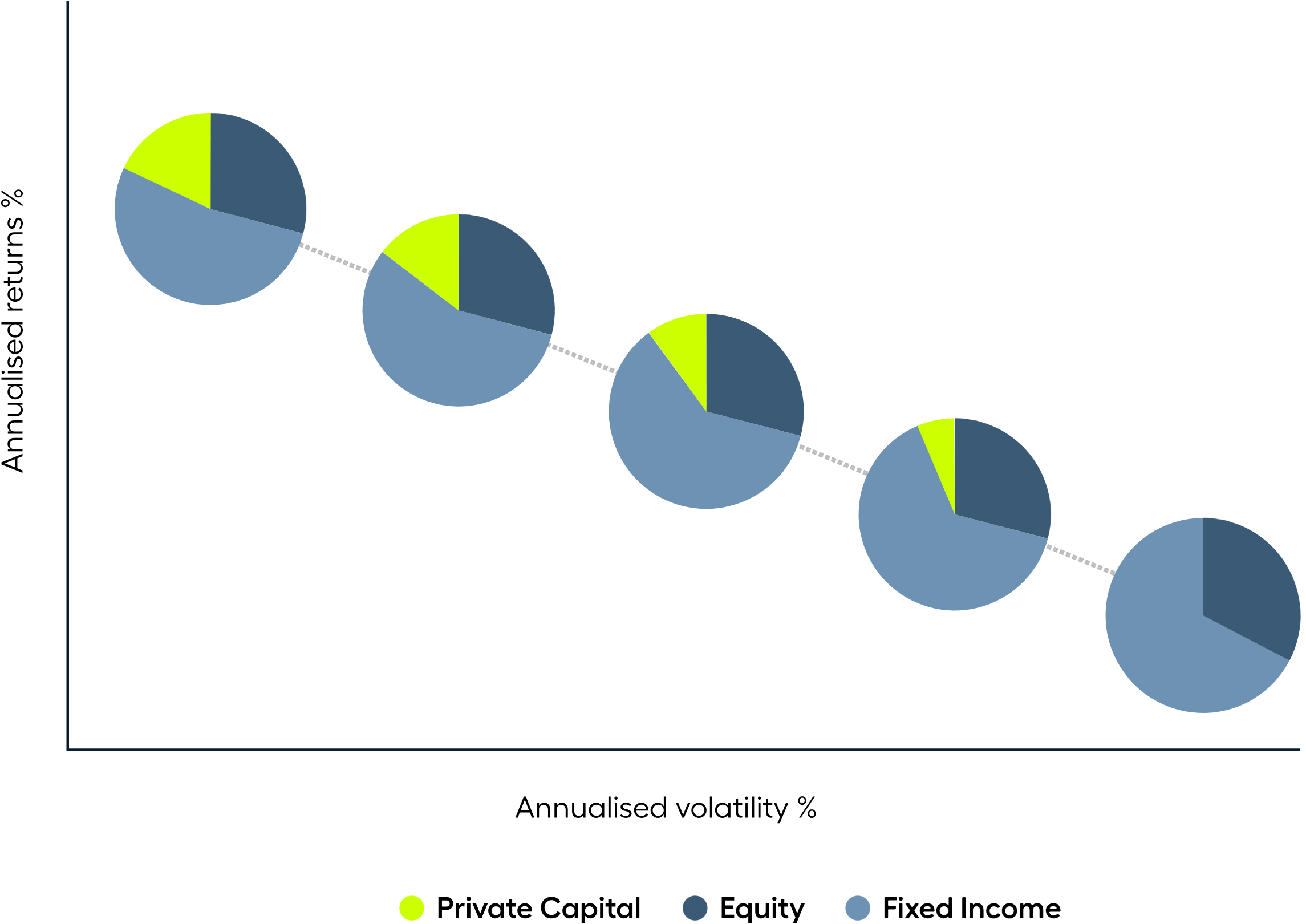

Here we see a series of portfolios and the positive effect of including private capital. I believe private capital, in terms of diversification, adds another dimension, which you will not be able to access without it.

Private capital adds a fourth dimension to the three main traditional markets: the money market, the fixed-income market and the equity market. This fourth dimension allows what we see in this chart: that these portfolios, in grey -portfolios with a 40%, 60% and 80% in equity-, increase their expected return and reduce their risk by introducing 30% of private capital.

In all cases, this portfolio moves up and to the left, which means higher returns and lower risk. For example, if you see the intermediate portfolio, which has 60% invested in the stock market, you can achieve a much more profitable portfolio with the same risk by including private capital.

Private capital provides the portfolio a greater expected return with the same risk: this is one of the major advantages of private capital.

When we talk about investments, it is very personal. If you are starting in this world, it is especially important to receive advice.

There is no specific amount that you should invest in private capital, there are opinions that range from 10% to 15% up to 25% to 30%. It depends on each person, your financial objectives, net worth, risk aversion...

The number one rule in private capital and all types of investments is to understand the product well. Videos like this one help us enter this world and understand it well.

You first have to understand the product and your risk limitations. In addition, in this case, we have to consider the time horizon, which is long. One must be convinced that they can manage these time horizons in their portfolio.

Often, people invest in the short term, because they believe that they need liquidity, and then they remain invested in the short term for 10 years. We must be careful with this, because we will lose many investment opportunities. We have to define the portion of the portfolio we are going to have tied up for longest, and that would be the amount we would invest in private capital, more or less up to 30%.

Viewing the masterclass can be used to earn 30 minutes of the EFPA recertification once the test is completed on EFPA's intranet.

This content is merely indicative. This content is merely financial training offered to you by Crescenta, without the intention of giving any type of personalised investment recommendation.

It is neither any type of advertising of financial instruments nor a recommendation or purchase offer.

Contents

It is recommended that private capital represents 30% of your portfolio

Adding private capital to a portfolio reduces volatility and adds profitability.

Diversifying enables us to reduce risk by maintaining investment opportunities

When you click on any underlined term, you can see a definition and example of each concept

When you click on any underlined term, you can see a definition and example of each concept

When you click on any underlined term, you can see a definition and example of each concept